National Bank of Malawi (NBM) Plc has expressed satisfaction with the innovations done by University of Malawi (UNIMA) Department of Physics and Electronics final-year students.

NBM Plc Information Technology, Organization, and Methods (ITOM) Division gave the students three challenges to solve and bring out innovative solutions with K2.8 million as funding for the projects.

On Friday, the students presented the innovations at NBM Headquarters in Blantyre, where Head of ITOM Designate Christopher Chilenga said part of NBM plc strategy has an aspect called ‘collaborations and partnerships’ recognizing that the Bank cannot have all the answers to the problems in the services but can get someone else on board.

“So far, I am impressed that they have taken up the idea, Universities are a centre of excellence, and they do have ways of addressing some of the needs and requirements we have in society. For them to look at the situation and propose ways of improving it is very commendable,” said Chilenga.

In his remarks, a UNIMA Lecturer, who is also the student’s projects supervisor Patrick Mzaza said what the students have demonstrated gives a positive hope that the students will help Malawi achieve its 2063 goals of advancing technology.

“They have developed three innovations which are addressing challenges that National Bank plc is facing. The first is the ATM monitoring system which monitors the temperature and humidity surrounding the machine.

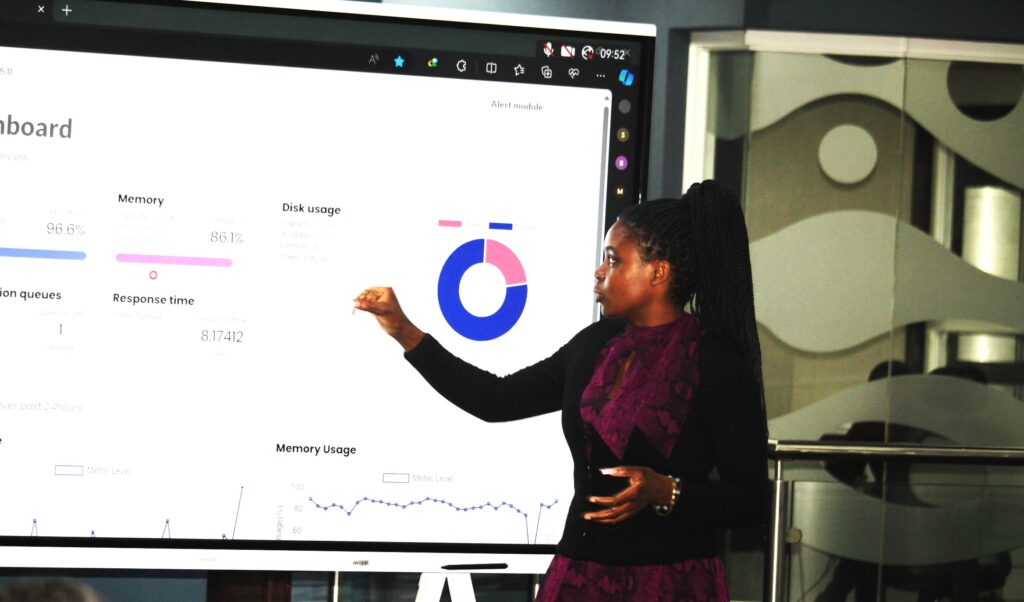

The second one is monitoring the parameters of a generator such as oil and fuel, and the last one is monitoring the bank’s systems in terms of transaction queues, memory usage of the CPU and everything,” said Mzaza.

Representing her group, a Bachelor of Science in Electronics final year student Bridget Matilesi thanked National Bank plc for supporting their audible and virtual alert monitor of the banking systems project.

“We are grateful for their support, and I would like to urge other institutions to come to UNIMA with their problems for students to innovate systems for them,” said Matilesi.