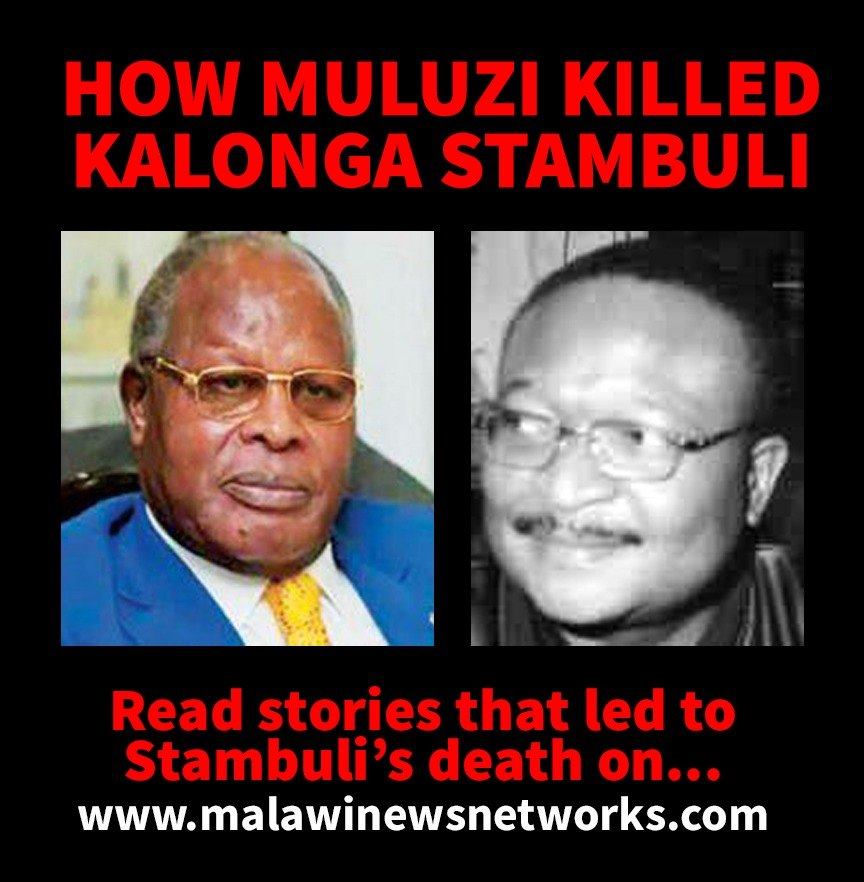

We continue to give you a dossier of corrupt scandals by former President Bakili Muluzi as exposed by his close aide Precious Kalonga Stambuli before Muluzi killed him in December 2003. This is Part 4

PART 4

BUSINESS LOANS

In 1995, Government established venture capital financing to encourage small and medium enterprise development that was considered an essential part of the “trickle up” economic strategy. The main source of funding was to be balances outstanding on PTA Bank line of credit of $10 million administered by the Reserve Bank of Malawi.

At the time, the Governor of the bank (now Minister of Finance) also identified small amounts amounting to 14 million. In total, therefore, the start up amount for the fund was K54 million, although the President announced that it was K100 million. The idea was that the Reserve Bank would print more money in the event of borrower’ demands exceeding the available amount.

Given this hanging financial plan for the fund, it came as a bigger surprise that on my return from a brief overseas trip I learnt that the President had made announcement raising the amount to K200 million, and that there was to be a Youth Fund with initial float of K75 million.

I must admit that the basic idea of a small scale enterprise fund was mine, because there had been a bitter compliant from the World Bank directed at my office concerning the President’s uncontrolled announcements at rallies that they were to get loans from the Malawi Rural Finance Company (MRFC). At the time, MRFC was just getting off the ground, and its initial capital was made up of payments from farmers who had borrowed under the Smallholder Agricultural Credit Authority (SACA) administered by the Ministry of Agriculture. Unfortunately the new government had shot itself on the foot when during campaign its functionaries had insisted that the amounts they had been advanced would be written off once they assumed power.

Despite the existence of small loan institutions like Sedom, the President instructed that the money should be kept in the Reserve Bank and disbursed on the basis of claims from institutions like DEMAT, NABW, and WWB. The programme started off without a well-designed application form, application of approval procedures. In the meantime the President had a parallel system that involved routing applications via State House. His signature was enough to compel the General Manager of DEMAT, now Minister of Agriculture, to make disbursement.

In the mean time meeting at the level of the Reserve Bank produced a formalised criteria for approval of loan applications, a ceiling of K250,000 for each loan, security pledge and execution of the appropriate legal agreements. A database was also set up that would monitor claims from the institutions, disbursements and the tail end of repayments.

By the time the system was in place, K70 million had been disbursed; half of the recipients were ghost borrowers. One year down the road, there had been no more than K1.5 million in repayments. Although the maximum loan size was K250,000 this could be circumvented by issuing ten loans of that amount against ten fictitious names. Requirements for collateral security were simply ignored and over 90% of the loans were given to persons on the basis of political support to the ruling party.

The channel of disbursements involved a catalogue of cheques of different amounts that was delivered to State House, classified by constituency. The cheques were then delivered to the beneficiaries a few days before a presidential visit. Beneficiaries included brothers and relations of the President as well as his female acquaintances.

As the money began to run out attention turned to Sedom, which had been excluded from the original scheme. Sedom was also just surfacing from a restructuring programme that had changed the outlook of the institution, making it eligible for more German funding for small enterprises. The President’s strategy was to install his personal friend Victor Likaku as Chairman of Sedom.

This time lists of women supporters of UDF were presented to the chairman for funding. Once the money was ready the women would be called to the Palace in Sanjika where cheques were handed out in front of the President. Conspicuously present on these occasions were chairman and general manager, Mr. Mapunda who was quickly removed as soon as he squirmed about corrupt practices.

It was not long before Sedom run dry and attention turned to FINCOM, whose chairwoman Mrs Kazembe was a member of the central executive of the UDF. FINCOM granted loans on verbal guarantees from the President. Major borrowers included Patrick Mbewe, then Minister of Tourism, Late Edward Bwanali, then Minister of Water and irrigation, the husband of Eunice Kazembe herself, and newspapers favouring the UDF, notably the Tribute of Mr Din Balakasi who got K1 million before disappearing into dubious diplomatic job.

An audit of FINCOM by the bank supervision staff of the Reserve Bank of Malawi revealed that FINCOM had become insolvent by 1997, a matter which was covered in the press. This jeopardised prospects of a transfer of shares from ADMARC to a new foreign owned NEDBANK of South Africa who had been interested in taking over the financial institution because of its client base in import financing.

In due course, the President’s attention turned to Indefund where directives were issued for loans to party functionaries. Resistance from Indebank produced a conspiracy, which saw General Manager out of the way because ADMARC is one of the shareholders.

In the mean time ADMARC had been compelled into small and medium scale funding purely on the basis of a bill of scale, and no other security. A Deputy Manager was quickly appointed to understudy the then General Manager, a Mr Kadzako who was believed to be an MCP sympathiser. The board was composed of functionaries like Chikwenga now MP for Malombe in Mangochi.

When the succession plan was thwarted by early death of the Deputy General Manager, the General Manager was unceremoniously removed paving the way for a Mr Makina to act as General Manager. This was the man that served as Treasurer for Muluzi’s recent wedding to his wife of 5 children.